Cryptocurrency purists have long predicted that decentralized exchanges (DEXs) would overtake centralized exchanges (CEXs), especially after catastrophic failures like the implosion of FTX in 2022, where at least $1–5 billion of customer funds vanished due to mismanagement. Yet here we are in 2025, and centralized platforms still dominate trading volumes by a huge margin. Today, October 2025, over 90% of trades still flow through centralized exchanges, the data tells the fact that CEXs have an average of 15X - 20X trading volume compared to DEXs. You can list dozens of reasons: UX, UI, self-custody, and more. But the simple truth is that DEXs just haven’t been good enough. And if they don’t catch up, they’ll miss the real growth of this industry.

SoDEX is built on a simple premise: if decentralized exchanges are going to matter, they need to perform, which is not just in principle, but in practice. That means lowering the barrier for users to entry, delivering speed without sacrificing transparency, and enabling far more efficient use of capital for traders and liquidity providers alike. Most DEXs today still fall short, and that’s why CEXs continue to dominate. This article unpacks why that is, and how SoDEX is architected to change the equation.

Rethinking Onboarding: SoDEX Builds Investor Confidence Where Other DEXs Don’t

It’s often assumed that complex wallet logins or seed phrases are the main barrier for newcomers. But after years of MPC and Keyless workarounds, the needle barely moved. The deeper issue is understanding and trust. With any new asset class, people move from awareness to understanding before they ever choose to invest. Most won’t buy what they don’t grasp. That’s the point many DEXs ignore, either they think it isn’t their job, or they’re not equipped to do it.

SoDEX tackles this directly by integrating the SoSoValue Research Terminal, a one-stop hub for crypto investing knowledge and live market context. SoSoValue, an AI-driven crypto research platform, ensures “each investor, regardless of location or knowledge level, can access the same high-quality information” about crypto assets via simple dashboards and AI tools.

- Research-first investing: Within the SoDEX ecosystem, users move from research to execution without switching contexts. The SoSoValue Research Terminal lets investors review a token’s fundamentals, track real time data, and compare assets before placing an order. By bridging the information gap, SoDEX builds the confidence required for this new asset class.

- Familiar trading workflow: Unlike many DeFi interfaces that confuse newcomers, SoDEX mirrors the look and feel of traditional brokerages and exchanges. An order book UI, standard order types, charts, and portfolio views keep the mental model simple. As the team notes, many DEXs were “built by DeFi degens” and come with high barriers; SoDEX is built around real user needs, offering a “seamless one-stop research and trading experience” and an “intuitive order book UI/UX for first-time users” , or in other words, a everyone-friendly design that doesn’t assume you’re already a crypto expert.

The combination of investment knowledge + a familiar UI + user-centric design means SoDEX can truly onboard new investors in a way existing platforms haven’t. In a landscape where even high-profile DEXs struggle to attract non-crypto natives, SoDEX’s holistic approach is a game changer, “not just an order execution tool, but a full cycle of investing in crypto” (as the SoSoValue team envisions). It builds investor mindset and confidence, not just trading capability. This is a supreme advantage in bringing fresh capital into crypto markets in a sustainable, informed way.

Built for Speed: SoDEX’s Layer-1 Solution Delivers Millisecond-Level Execution While Ensuring Decentrilized

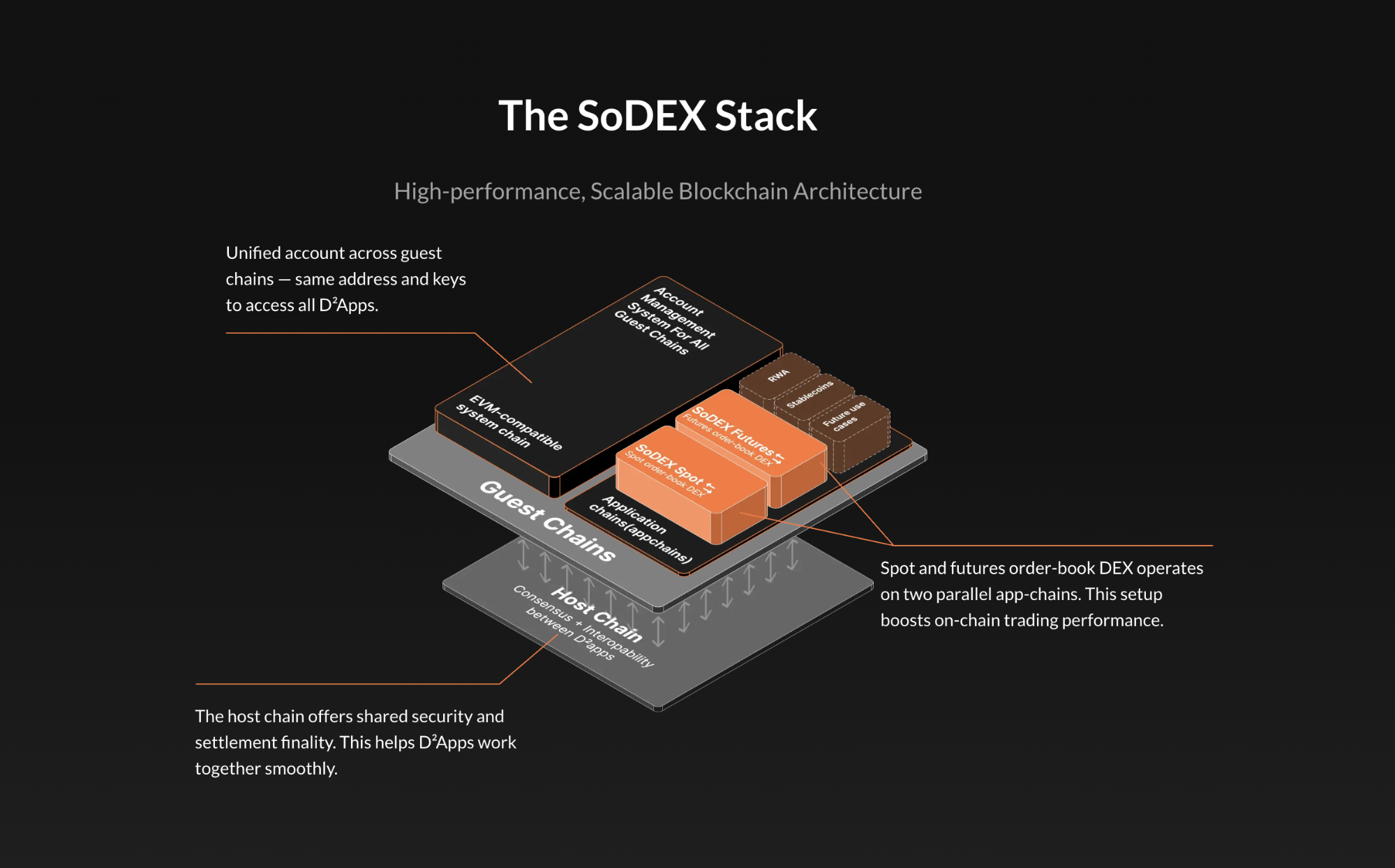

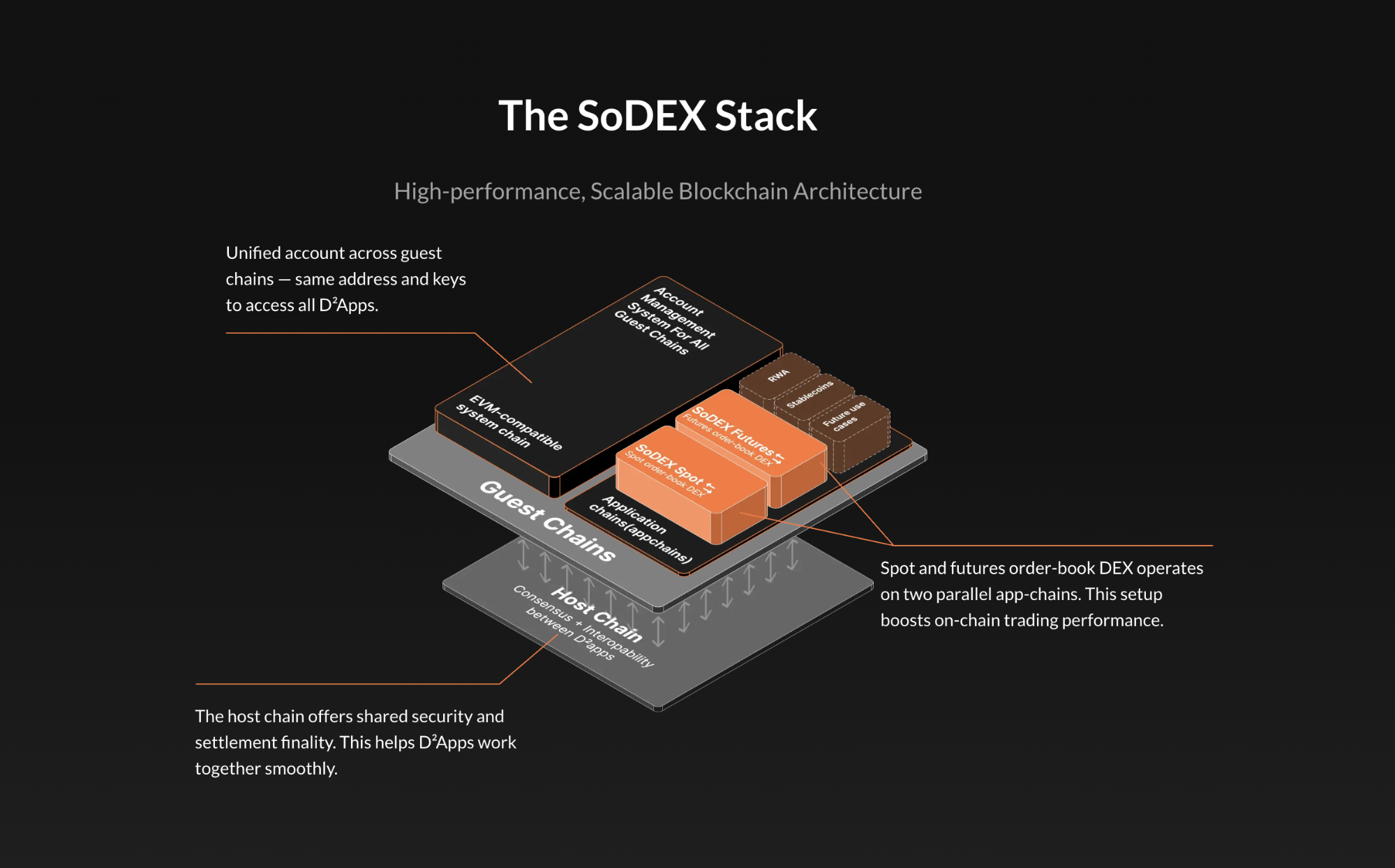

Most DEXs hit a wall on performance. An order-book exchange that runs fully on-chain at global scale needs something different from a general-purpose chain. That’s why SoDEX runs on ValueChain, a Layer-1 built for finance: millisecond-level matching, high throughput, and instant, auditable settlement. The goal isn’t flashy benchmarks; it’s to make an on-chain order book feel as responsive as a pro exchange while keeping every order, cancel, and fill on the ledger.

Plenty of DEXs teams have recognized this performance bar for a long time, but most of them bridge the gap by moving the hard parts off-chain—centralized matchers, privileged sequencers. You get speed, but you lose credible neutrality. And turned out their DEX is not much unlike a CEX with wallet login system, and KYC free. No data transparency is not only bringing trouble in later anti-money laundry regulation checks, but also enabling too much unfair behaviour in trading itself. General investors may tolerate this setup because it is often the only option today, but once they feel the direct impact on themselves, like system outages, blocked order submission, unexplained fills etc., they immediately lose trust in that platform and, over time, in any centralized venue.

SoDEX takes the harder route: keep matching and settlement on-chain, keep state transparent, and still hit millisecond execution. ValueChain’s architecture is purpose-built for this: an order-book VM and parallelized execution so the matching engine runs where it should—on the chain, without turning the network into a bottleneck.

By building a high-performance chain tailor-made for finance, SoDEX removes the efficiency gap that has long separated DEXs from traditional exchanges. Investors, especially institutions or professionals, are more likely to use a platform that feels instantaneous and reliable, without the usual lags of block confirmations. At same time, decentralized solutions make sure of the transparency and fairness of platform. It’s speed and security in one package, tailor-built for the next generation of decentralized finance.

Breaking the AMM Trap: SoDEX Brings Capital Efficiency Back to DeFi

Breaking the AMM Trap: SoDEX Brings Capital Efficiency Back to DeFi

For crypto exchange solution, the first broadly adopted DEX design was the AMM model. It's the first time that a smart contract has taken place of middleman in the currency exchange business. But when it came to 2025, "trustlessness" shifted from a headline feature to a basic expectation, we also have to face the crucial fact that the AMM model has a core weakness, capital inefficiency.

Liquidity Providers lock assets in pools and earn only swap fees. In early models, they also faced impermanent loss, which brings them systematic underperformance versus just holding whenever prices moved. To keep capital parked, AMM DEX protocols have no other choice but to incentive liquidity providing behavior, which is so-called liquidity mining. But the story always comes to that protocols have to emmision tons of their own token as incentive, while no other utility to support the price of token, and capitals(LPs) just shifting towards the best offers, with nearly no transfer cost. Research across cycles shows the same pattern: incentives spike TVL temporarily, and depth recedes when rewards taper.

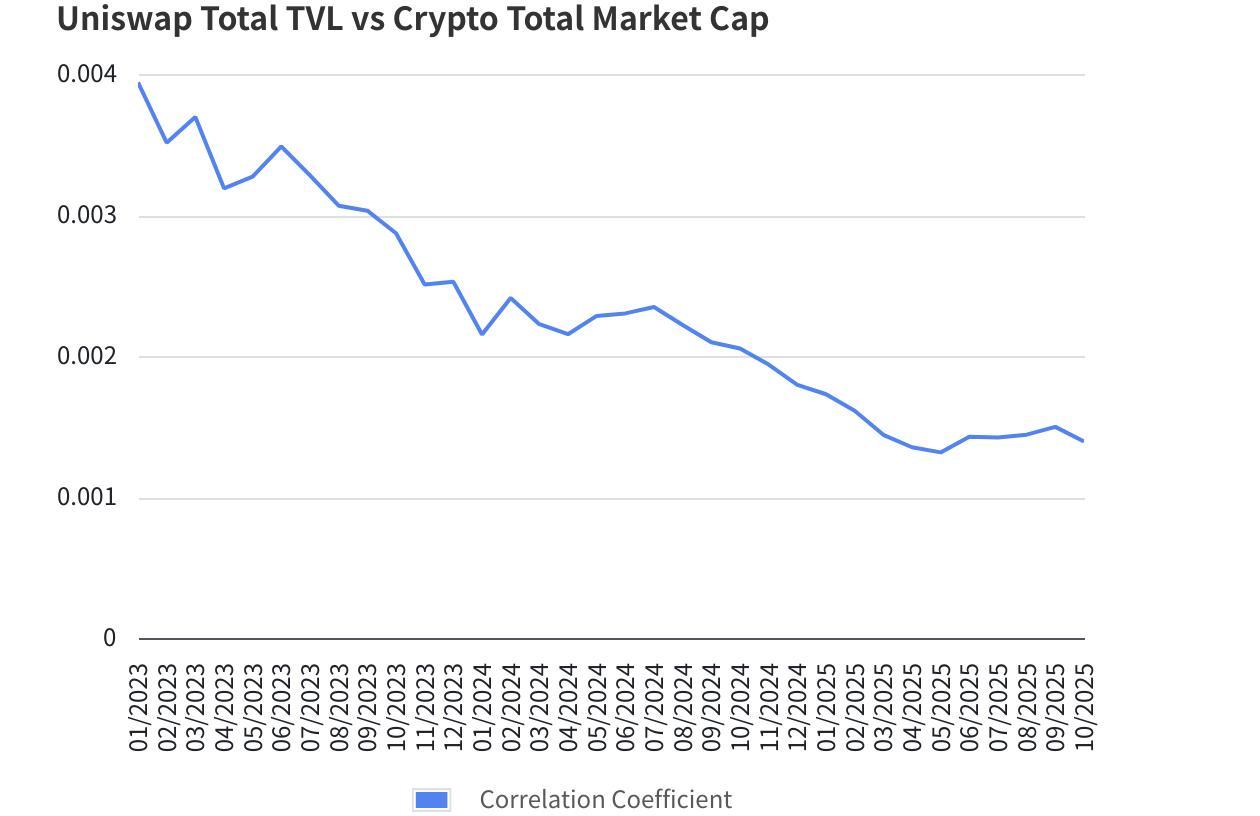

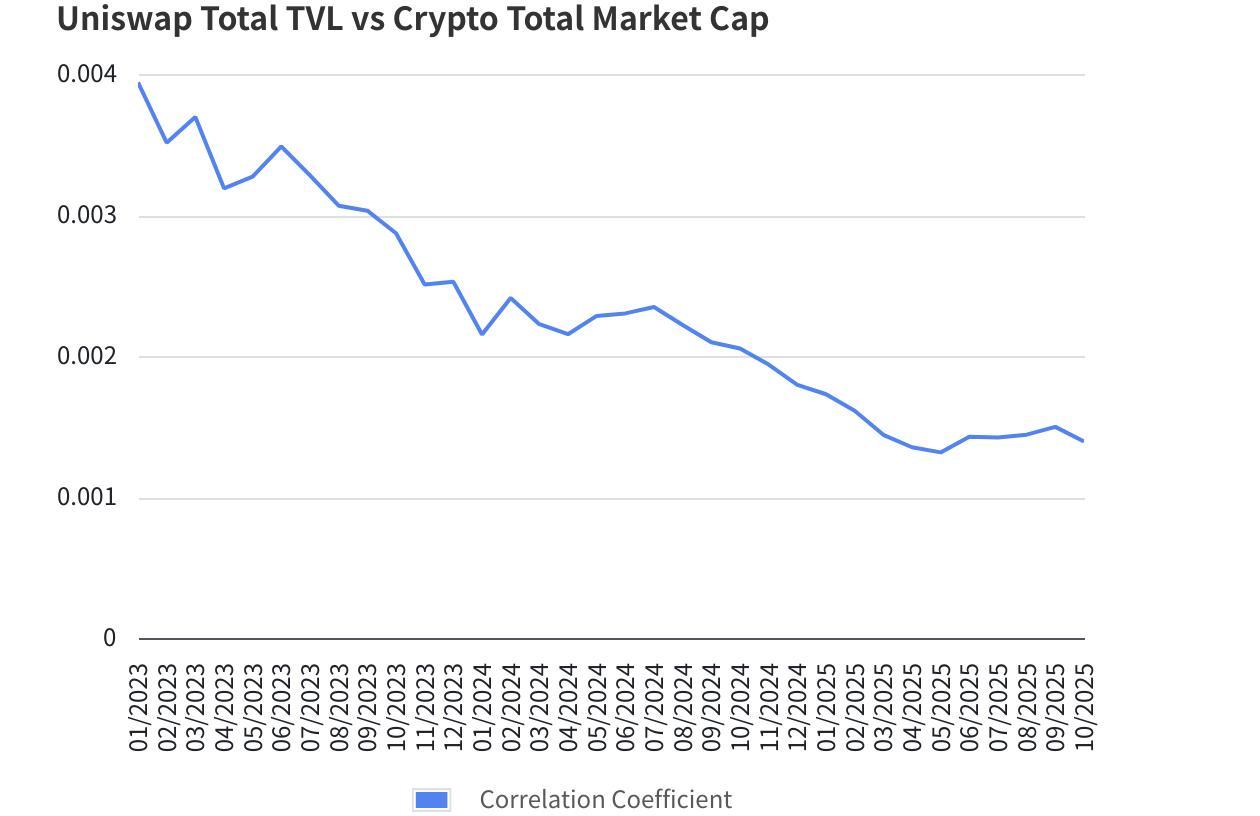

Since 2023, as total crypto market cap climbed, Uniswap TVL’s correlation to market cap has fallen. That signals new money isn’t flowing into AMM pools in step with industry growth, which means capital is either seeking better risk-adjusted returns elsewhere or avoiding range-bound exposure that bleeds in volatile regimes. In short: AMMs tie up too much money for the volume they facilitate, and they often require permanent incentives to look competitive.

Since 2023, as total crypto market cap climbed, Uniswap TVL’s correlation to market cap has fallen. That signals new money isn’t flowing into AMM pools in step with industry growth, which means capital is either seeking better risk-adjusted returns elsewhere or avoiding range-bound exposure that bleeds in volatile regimes. In short: AMMs tie up too much money for the volume they facilitate, and they often require permanent incentives to look competitive.

SoDEX uses a central limit order book (CLOB), where liquidity sits at specific prices: exactly where demand exists, instead of being smeared across an infinite curve. That alone flips the capital-efficiency equation:

- Better market quality, especially when it matters: In large liquid pairs, the difference can feel subtle day to day; spreads are tight everywhere. But at size, in smaller pairs, and during fast moves, CLOBs shine: quotes cluster near fair value, price impact is lower, and books can refill quickly. For investors, that means tighter effective spreads, more predictable fills, and less “tax” from slippage when volatility hits.

- No dependence on emissions to keep depth: Because capital is only committed where it earns (resting quotes that actually trade), makers can be paid from real trading economics—maker/taker fees and rebates—rather than inflation token emissions. SoDEX’s model doesn’t hinge on endless yield programs just to keep pools alive. Depth that persists without a bribe is healthier and stickier.

- Unified depth across chains: SoDEX aggregates assets from ecosystems like Ethereum and Solana into a single order book via its native custody/bridging stack. Instead of fragmented TVL per chain (ETH pool here, BSC pool there), all liquidity meets in one place, boosting depth and reducing slippage. The effect is simple: tighter books, fewer hops, better prices, makes the trading experience closer to a top-tier centralized venue, without surrendering on-chain settlement.

AMMs were the right invention for a trust-starved moment, but they burn capital to simulate depth and lean on emissions to retain it. A CLOB concentrates liquidity where trades happen, pays participants from actual volume, and scales without printing. With cross-chain consolidation on top, SoDEX’s order-book model delivers better prices, more reliable depth, and none of the hidden costs of impermanent loss or perpetual token subsidies. As markets mature and capital demands efficiency, that’s the winning design.

Real Assets, Real Security: Native-Backed Spot Trading Sets SoDEX Apart

Although SoDEX runs on its own Layer-1, it has been built to connect with the broader crypto universe rather than a pure trading platform. A key differentiator is SoDEX’s approach to asset custody and backing. When you buy cryptocurrency on SoDEX, you’re not just dealing with synthetic IOUs or solely with derivative contracts – you’re trading tokens that are fully backed by real assets on their native chains. SoDEX achieves this through a secure bridging and custody framework: real assets ( BTC, ETH, SOL, or even real-world assets like tokenized stocks) are held in institutional-grade custodial solutions, and equivalent tokens are minted on ValueChain for trading.

The benefits of this approach are significant, because trades are settled by actual asset transfers on-chain (or by claims on assets held in custody), you don’t face the risk of a deal defaulting by a “trading opponent.” In traditional finance or some crypto derivatives platforms, if your counterparty fails to deliver, you’re exposed to loss. On SoDEX, the smart contracts and custody guarantees ensure that if you bought cryptocurrencies, the asset is there, and you’re not relying on another trader’s solvency. Even for more complex products like futures or perpetuals, SoDEX’s design (using on-chain collateral and robust risk management) avoids the need to trust a central clearinghouse or exchange operator with your funds.

By focusing on spot trading and real asset exposure, SoDEX encourages an investor mentality rather than pure speculative trading. Many decentralized trading platforms (order-book or AMM alike) have gravitated towards perpetual swaps and leveraged products. While SoDEX is also capable of supporting derivatives, its flagship offerings include spot crypto tokens, tokenized stocks, and index tokens that users can buy and hold long-term This aligns with SoSoValue’s broader mission to “sustain healthy and long-term participation in the crypto market” In fact, the SoSoValue team previously launched SoSoValue Indexes (SSI) – a set of on-chain crypto index tokens designed for passive, long-term investment in the sector’s growth. That same philosophy is evident in SoDEX. Instead of catering only to high-risk traders trying to outgun each other (a zero-sum game), SoDEX provides products for buy-and-hold investors to gain diversified exposure to crypto and even real-world assets on-chain. For example, an investor on SoDEX could purchase an index token that tracks a basket of top DeFi tokens, or a tokenized share of a tech company, and hold it with confidence that it’s backed by real value. This investing-focused approach sets SoDEX apart from other decentralized order-book exchanges (many of which primarily offer perpetual futures). It’s a platform where one can invest in the growth of the crypto industry rather than just speculate on short-term price swings.

Why SoDEX Stands Out Among Decentralized Exchanges

SoDEX pairs a trading venue with SoSoValue’s research, so users know what they’re investing excatlly, closing the knowledge gap. It runs on ValueChain, keeping matching on-chain with millisecond responsiveness speed without off-chain black boxes process. And as a CLOB, not AMM, liquidity concentrates at real prices, slippage drops at size, and depth is funded by fees, not just token emissions incentives. Spot positions are backed 1:1 by native assets, enabling true ownership and long-horizon investing (spot, indices, tokenized stocks).

Add it up: investor onboarding + on-chain speed + capital-efficient books + native-backed spot. That combination is rare. It answers why DEX volume still trails CEXs, and offers a credible path to close the gap: better fills, cleaner economics, and behavior you can verify when markets get rough.

Watchlist

Watchlist Ads

Ads Today's best

Today's best

All time Best

All time Best New listings

New listings Airdrops

Airdrops Presales

Presales Submit coin

Submit coin Contact Us

Contact Us Blog

Blog Dictionary

Dictionary Bitcoin Halving

Bitcoin Halving Partners

Partners

KYC verification

KYC verification AMA hosting

AMA hosting

Breaking the AMM Trap: SoDEX Brings Capital Efficiency Back to DeFi

Breaking the AMM Trap: SoDEX Brings Capital Efficiency Back to DeFi Since 2023, as total crypto market cap climbed, Uniswap TVL’s correlation to market cap has fallen. That signals new money isn’t flowing into AMM pools in step with industry growth, which means capital is either seeking better risk-adjusted returns elsewhere or avoiding range-bound exposure that bleeds in volatile regimes. In short: AMMs tie up too much money for the volume they facilitate, and they often require permanent incentives to look competitive.

Since 2023, as total crypto market cap climbed, Uniswap TVL’s correlation to market cap has fallen. That signals new money isn’t flowing into AMM pools in step with industry growth, which means capital is either seeking better risk-adjusted returns elsewhere or avoiding range-bound exposure that bleeds in volatile regimes. In short: AMMs tie up too much money for the volume they facilitate, and they often require permanent incentives to look competitive.