The launch of CoinFutures could not have come at a better time. As traders return to the crypto markets and gamified trading continues to gain traction, CoinPoker's decision to step into the futures space with CoinFutures feels both timely and strategic.

With more people seeking fast, responsive trading formats that bypass the usual exchange hurdles, CoinFutures offers a cleaner, more immediate way to engage with short-term market moves. This review dives into what the platform brings to the table, how it works, and whether it truly delivers on its promise.

What is CoinFutures and What Makes it Different?

CoinFutures is a crypto futures betting product developed by CoinPoker, not by a typical centralized exchange. This distinction matters, as instead of attempting to replicate a traditional trading terminal, CoinFutures simplifies the entire concept into a game-like structure that still respects the mechanics of real market dynamics.

Built within the CoinPoker ecosystem, CoinFutures lets users bet on the short-term price movement of cryptocurrencies without needing an exchange account or wallet connection.

Users choose an asset from a huge list of options which includes cryptos like BTC, ETH, SOL and even memecoins like WIF, PENGU, etc., and place a directional bet by selecting "long" or "short." They also set a multiplier that determines both their potential payout and the bust price, which is the point at which the trade fails.

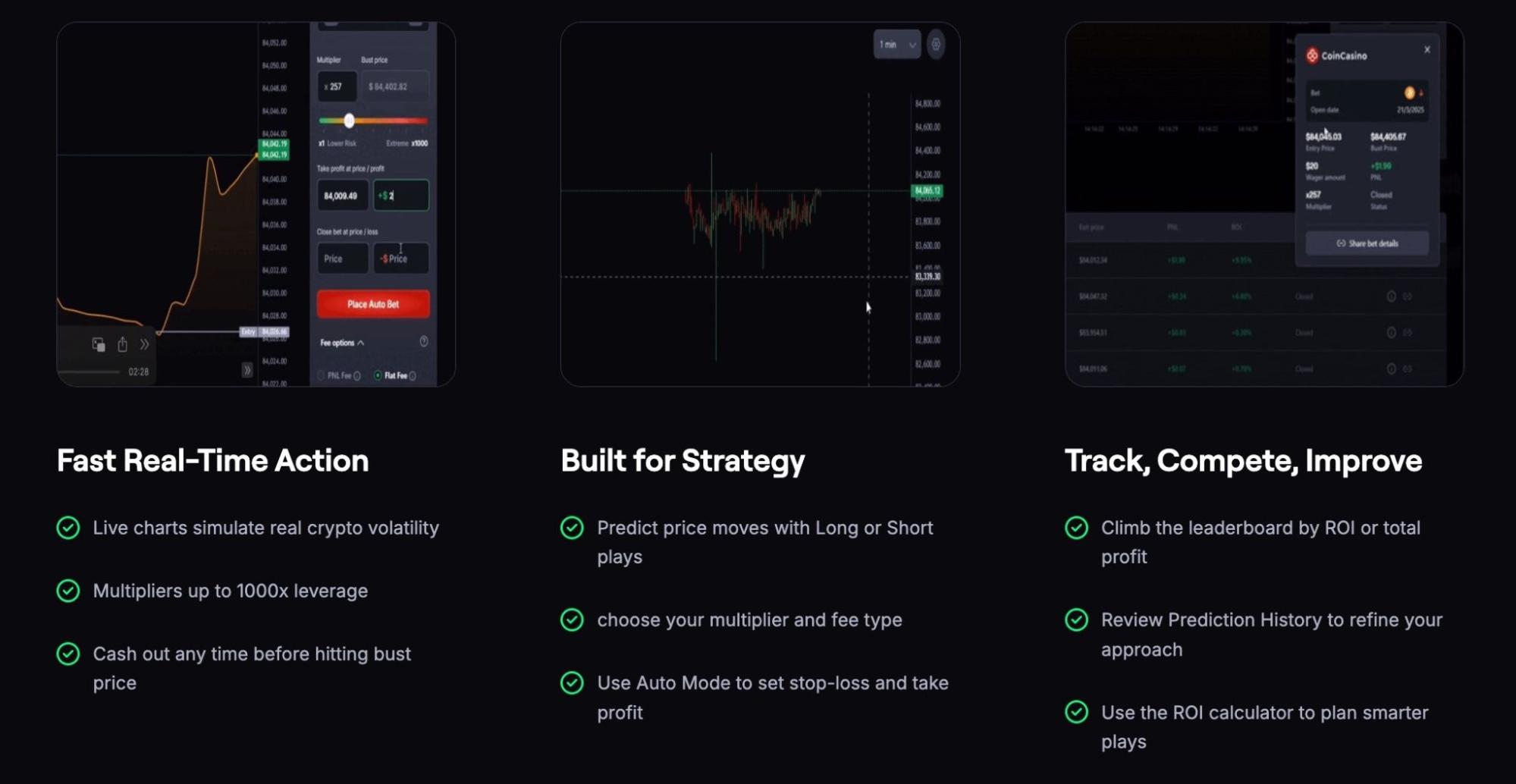

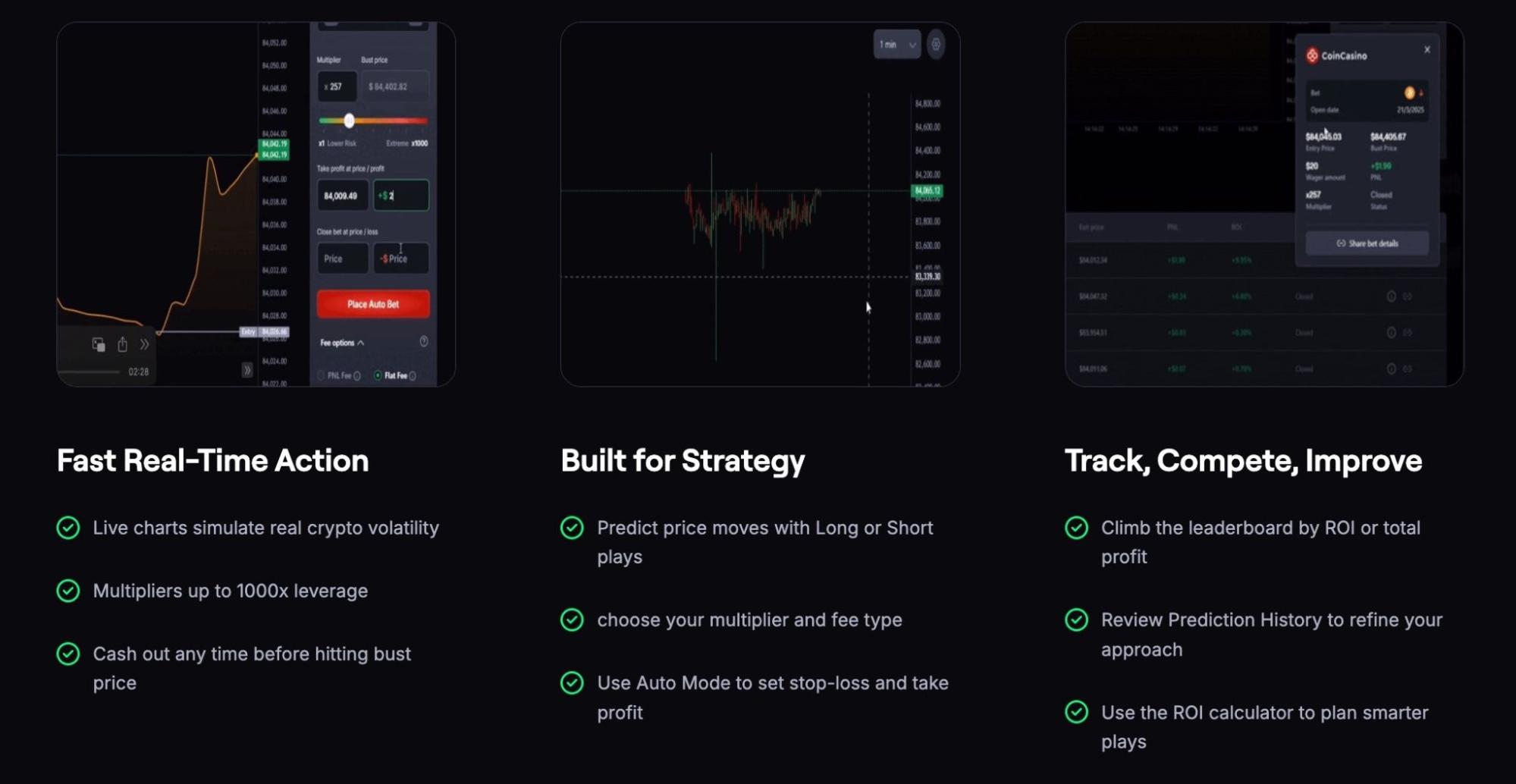

Contrary to standard leveraged futures practices, everything happens on a single interface with real-time charts, instant feedback, and rapid settlement. It essentially mimics the thrill of price action trading while trimming the technical fat that usually comes with it. And because the price movement is simulated based on actual crypto volatility, the experience retains market realism without being a direct mirror of exchange-based data.

This is not a training simulator, nor is it just a prediction game. CoinFutures occupies a space in between, which is accessible, strategic, and fast, all inside a system where players manage risk and rewards on their own terms.

CoinFutures - Pros and Cons

Pros

- No KYC, Instant Access: Users can start playing without providing identity documents or undergoing verification.

- Fast Gameplay Mechanics: Bets are placed and settled quickly, giving users full control over entries and exits.

- Realistic Market Feel: The price chart mirrors real crypto volatility for a high-fidelity experience.

- Risk Control Features: Options like Stop Loss, Take Profit, and Auto Mode give users tools to manage exposure.

- Strong Parent Platform: Backed by CoinPoker, a platform with an established reputation and loyal user base.

Cons

- Limited Asset Selection: Currently restricted to just BTC and ETH, with more coins still pending.

- No Demo Mode: Beginners may have to risk real funds to fully grasp how the system works.

- Fixed Bet Limits: Users face restrictions on the number of active bets and max profit per trade.

CoinFutures - Function and Features

Let us take a look now at the operational element of CoinFutures and the steps involved to get started with the platform.

Let us take a look now at the operational element of CoinFutures and the steps involved to get started with the platform.

How it Works

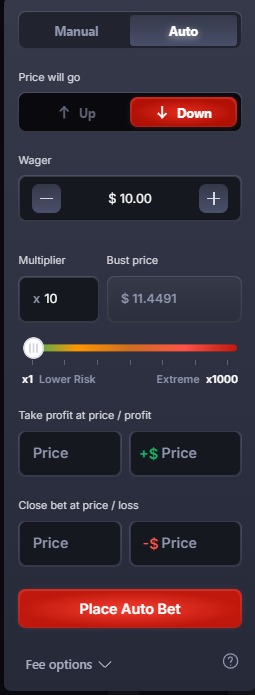

The process starts by selecting an asset from the available options. The platform displays a real-time chart simulating price movements. The user then decides on the bet direction – long for upward movement or short for downward. A multiplier is chosen, which not only amplifies potential profits but also tightens the margin for error through the bust price mechanism.

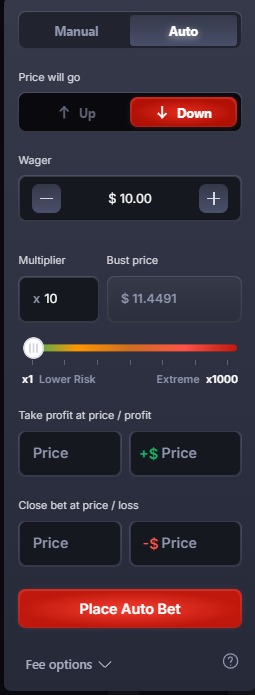

Once a user enters a bet amount and fee structure (flat or profit-based), they can either place the trade manually or activate Auto Mode. The latter allows for pre-configured settings like stop loss, take profit, and cash-out thresholds. The trade plays out in real time on the chart, and users can monitor the entry price, exit conditions, and overall ROI.

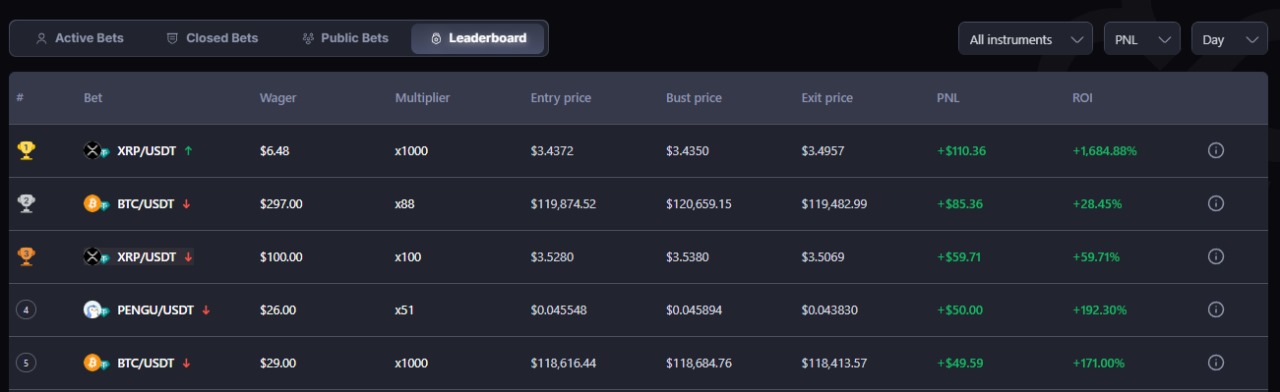

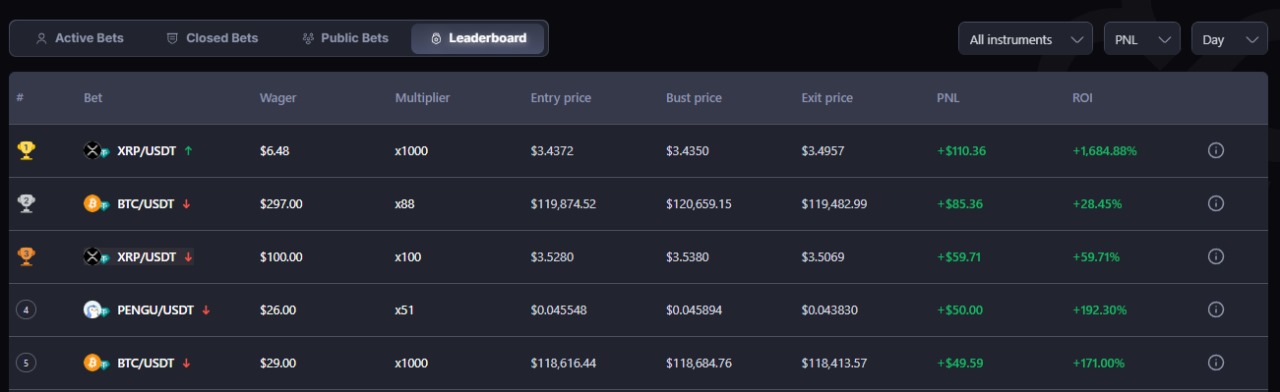

If the market moves in the predicted direction without hitting the bust price, the user can cash out for a gain. If it reverses and hits the bust threshold, the trade is lost. A built-in ROI calculator is also available for planning, and the leaderboard adds a competitive edge for those who want to see how their returns compare to others.

Top Features

1) Real-Time Volatility Simulator

CoinFutures is driven by a live pricing engine that mirrors actual market conditions. This keeps the gameplay sharp, responsive, and rooted in reality without needing a full exchange backend.

2) Auto Mode with Risk Controls

Users can automate their trades using precise rules for entry, exit, profit capture, and loss prevention. The Auto Mode feature gives structure to strategies while still allowing fast execution.

3) ROI Calculator

Built into the betting interface, this tool helps users estimate potential returns based on their bet size, multiplier, and fee preference. It’s practical and encourages more deliberate decision-making.

4) Performance Leaderboard

The leaderboard ranks players by ROI and total profit over different timeframes. It introduces a sense of progression and peer comparison that keeps the experience competitive.

How to Use CoinFutures

- Step 1 - Pick Your Asset: Choose from the wide variety of existing cryptos, with more to come soon.

- Step 2 - Direction of Bet: Select "long" if you think the price will go up, or "short" if you expect it to drop.

- Step 3 - Enter Bet Amount: Input how much you want to risk within the allowed limits.

- Step 4 - Select Multiplier: Decide how much leverage you want. Higher multipliers increase potential returns but also the risk of busting early.

- Step 5 - Fee Option: Choose between a flat entry-exit fee or a percentage cut of profits.

- Step 6 - Manual or Auto Mode: Either place the trade yourself or use Auto Mode to predefine your strategy.

- Step 7 - Track and Close: Watch your trade on the chart and decide when to cash out. If you hit the bust price, the trade ends automatically.

- Step 8 - Check Bet History: After the trade, review outcomes to assess what worked and what didn’t.

Is CoinFutures Legit?

CoinFutures benefits significantly from its parent platform, CoinPoker, which already commands respect in the blockchain gaming world. Known for handling real money games with transparency and fast processing, CoinPoker has earned a reputation that carries over to CoinFutures.

From its clean interface to its transparent mechanics and strong back-end support, CoinFutures doesn’t cut corners. Its focus on control, strategy, and user autonomy makes it more than just a gimmick. There is no hard sell, just a system that works for those who understand how to read a chart and manage their risk.

Whether you’re curious about a new kind of trading experience or want a competitive setting to test your instincts, CoinFutures delivers something that feels refreshingly different, yet grounded in logic and execution.

Visit CoinFutures

Watchlist

Watchlist Ads

Ads Today's best

Today's best

All time Best

All time Best New listings

New listings Airdrops

Airdrops Presales

Presales Submit coin

Submit coin Contact Us

Contact Us Blog

Blog Dictionary

Dictionary Bitcoin Halving

Bitcoin Halving Partners

Partners

KYC verification

KYC verification AMA hosting

AMA hosting

Let us take a look now at the operational element of

Let us take a look now at the operational element of